US manufacturers are constantly seeking ways to reduce manufacturing costs while maintaining high-quality production. One strategy that has gained significant popularity in recent years is maquiladora manufacturing in Mexico.

Maquiladora manufacturing is an option that involves importing raw materials, components, or partially finished goods into designated Mexican border zones for assembly or processing and exporting the finished products all duty-free or under reduced tariffs. These factories are sometimes called maquilas and fall under Mexico’s IMMEX program. This option allows companies to take advantage of cost-effective labor and economic incentives while leveraging proximity to markets, particularly the US

There are numerous ways Mexican maquiladoras can save money for US producers. And in this article, we will explore multiple strategies US manufacturers can leverage to forego offshoring their operations in order to reduce manufacturing costs. US manufacturers using this alternative can realize critical saving in several key areas. Below are just seven of them.

Lower Labor Costs

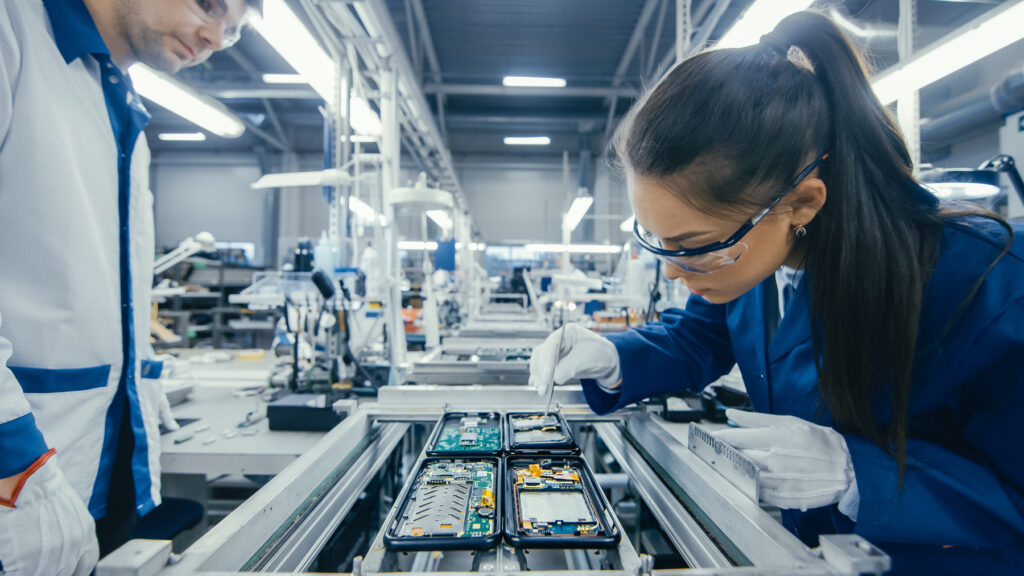

One of the most significant cost-saving advantages of maquiladora manufacturing in Mexico is the lower labor costs compared to the United States. Mexico has a large and skilled workforce, with wages that are significantly lower than those in the US, allowing US manufacturers to reduce labor costs without compromising on the quality of their products.

In addition, Mexico’s labor laws, such as the Federal Labor Law, offer flexibility in terms of work hours, overtime, and labor regulations, which can result in additional cost savings for US manufacturers. This allows manufacturers to adapt their production schedules based on demand, resulting in more efficient and cost-effective operations.

Favorable Trade Agreements

Mexico has several favorable trade agreements that provide cost-saving benefits to US manufacturers operating in maquiladoras. For instance, the North American Free Trade Agreement (NAFTA) and its successor, the United States-Mexico-Canada Agreement (USMCA), allow goods to be imported and exported between the three countries with reduced or eliminated tariffs. This eliminates or minimizes customs duties, taxes, and other trade barriers, resulting in significant cost savings for US manufacturers.

Additionally, Mexico has trade agreements with over 40 countries, providing US manufacturers with access to global markets at reduced tariff rates. These trade agreements also allow for easier movement of goods and materials across borders, reducing transportation costs and lead times.

Access to Skilled Workforce

While the US is still experiencing a sharp labor shortage, Mexico has a large and skilled workforce that is well-trained in manufacturing processes. Furthermore, many maquiladoras collaborate with local universities and vocational schools to provide specialized training programs for their employees. This allows US manufacturers to access a trained and skilled workforce without incurring additional training costs, further reducing labor costs and improving production efficiency.

Cost-Effective Real Estate and Infrastructure

Maquiladoras in Mexico offer US manufacturers cost-effective real estate options and infrastructure facilities. Mexico’s industrial parks and zones designated for maquiladora manufacturing in Mexico are strategically located near the US border, providing easy access to transportation networks and allowing companies to reduce manufacturing costs associated with transportation and logistics.

These industrial parks often offer modern and well-equipped facilities, including factories, warehouses, and offices, at competitive prices compared to the United States. This allows US manufacturers to set up their operations in cost-effective facilities, saving on upfront capital costs and ongoing operational expenses.

Reduced Regulatory Compliance Costs

Compared to the United States, Mexico has a simplified regulatory environment for manufacturing operations, which can result in reduced compliance costs for US manufacturers. Mexico’s regulatory framework for maquiladora manufacturing is designed to promote foreign investment and streamline business operations.

For example, Mexico has a value-added tax (VAT) certification program that allows maquiladoras to import raw materials and equipment duty-free, reducing importation costs. Additionally, Mexico has implemented the IMMEX program (Industria Manufacturera, Maquiladora y de Servicios de Exportación), which provides maquiladoras with benefits such as reduced paperwork, expedited customs clearance, and simplified regulatory requirements, resulting in cost savings for US manufacturers.

Increased Flexibility and Scalability

Of the many strategic benefits of maquiladora manufacturing in Mexico, flexibility and scalability are often overlooked. Maquiladoras are designed to be agile and responsive to changing market demands, allowing US manufacturers to adjust their production volumes and schedules quickly. This flexibility enables US manufacturers to respond to changes in market conditions, customer demands, and production requirements, without incurring significant costs associated with retooling or reconfiguring their production facilities.

Furthermore, maquiladoras in Mexico offer scalability options for US manufacturers. As the manufacturing needs of a US company grow, maquiladoras can easily accommodate the increased production volumes by adding additional production lines, expanding warehouse space, or increasing workforce. This scalability allows US manufacturers to scale their operations in a cost-effective manner, without incurring significant capital investments and operational costs.

Enhanced Supply Chain Management

Mexico’s strategic location as a neighboring country to the United States provides US manufacturers with enhanced supply chain management options. Manufacturing in Mexico allows US manufacturers to have better visibility and control over their supply chain, reducing lead times, transportation costs, and inventory holding costs. US manufacturers can also benefit from the close proximity of their suppliers, as many suppliers also have operations in Mexico to take advantage of the cost savings and trade agreements.

Getting Started

US manufacturers can start their Mexican maquiladora journey by conducting thorough research on the legal, financial, and operational requirements. This includes understanding the regulations and processes associated with setting up a maquiladora in Mexico. Seeking professional assistance from local legal counsel, tax advisors, and customs brokers can help navigate the complexities of the maquiladora program.

Once the research is done and professional help is engaged, the next step is to choose the right location for the maquiladora. Factors to consider include proximity to the US border, availability of qualified labor, infrastructure, and transportation options. Working with local experts can help in identifying the ideal location for the maquiladora operations. By following these and other steps detailed in our Complete Guide to Maquiladora Manufacturing, US manufacturers can lay the groundwork to reduce manufacturing costs long term by establishing a successful maquiladora in Mexico.